Leap

Growing the loan book to £2M in 6 months at this early stage fintech-for-good P2P startup.

Principal Designer 2016 - 2018

Context

Designing digital tools to build financial wellness in the UK

There are 6 million of people in the UK that believe they will never be able to break free from debt.

The average Brit has racked up £8,000 in bad debt, excluding mortgages and student loans. Paying high interest rates to the banks on credit cards and overdrafts make the bulk of it.

And on the other side of the financial spectrum…

There are consumers whose savings, investments and ISAS have been suffering from years of record-low rates…

Problem

The personal finance system is dominated by banks where both. borrowers and investors are loosing out

Unfair, right?

We decided to disrupt these stablished practices of borrowing and investing to create a win-win scenario for the people, not the banks.

What if… consumers invest and borrow from each other and help each other to achieve their financial goals?

Opportunity

Welcome to Leap

In our marketplace investors and borrowers, lend and borrow from each other directly. By cutting out the banks, investors get real returns and borrowers get lower rates on their debt.

Goal

Releasing a solution as fast as possible to learn.

Taking a traditionally complex subject like personal finance and make it ethical, simple and accessible to borrowers and investors.

Research

I formulated the key questions driving the research phase

The goal was learning about:

How borrowers ask for loans and what do they have to go through?

How investors go about investing and what do they have to go through?

How do borrowers/investors manage their personal finance?

What are others doing about this issue? Who are they?

Which sentiments are associated with borrowing and investing money?

Quidcycle audit

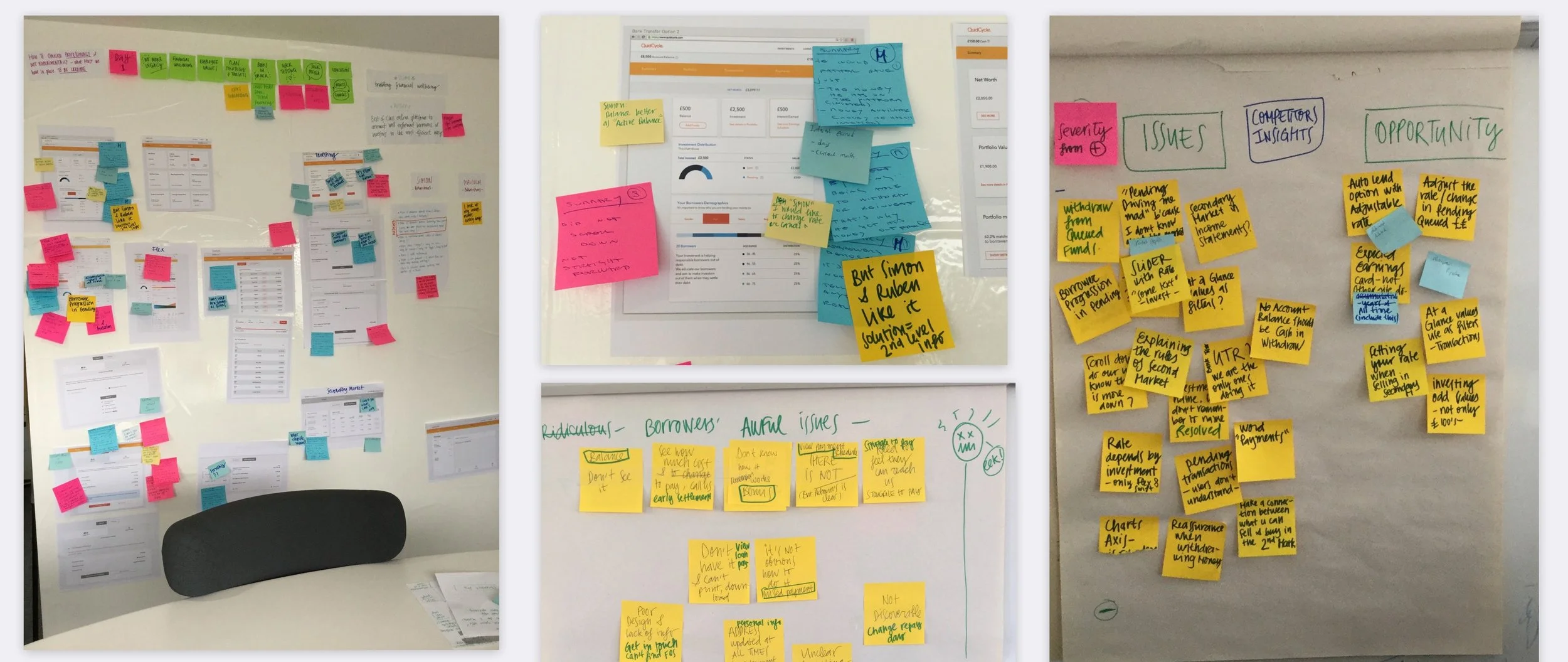

There was an existing website and admin platform. Focusing on the functionality and the UI, I analysed their existing processes and identified multiple issues:

Onboarding users was a manual process taking back office staff up to two months.

Investors and borrowers had lending visibility only through emails.

There were 3 investing products with unclear proposition.

Product-market fit

I carried competitive research to understand our product-market fit.

The users

In addition to interviewing 24 users, I sent out a survey that reached hundreds of respondents. Furthermore, I captured quantitative data from verified sources, such as consultancies like PWC, on topics including lending, borrowing, new financial models, and the state of British personal finance. This comprehensive approach allowed me to gain a deep understanding of our users beyond the context of our product.

Define

With the collected data I defined the challenges and issues

While each user type had a variety of needs and pain points, across all user types, it was clear that

Investors are proactive, money savvy and will accept risks to achieve their goals.

For investors, word of mouth is important. They talk about money and spend one hour a day reading related literature, checking their accounts…

Borrowers don’t like to talk about money and the sentiment is rather negative.

Good borrowers make investors happy, hence the business needs to focus on the relationships with the borrowers segment.

P2P remains largely unknown, so we need to define it as a new kind of organisation, defined by its values as much as its value.

Design strategy:

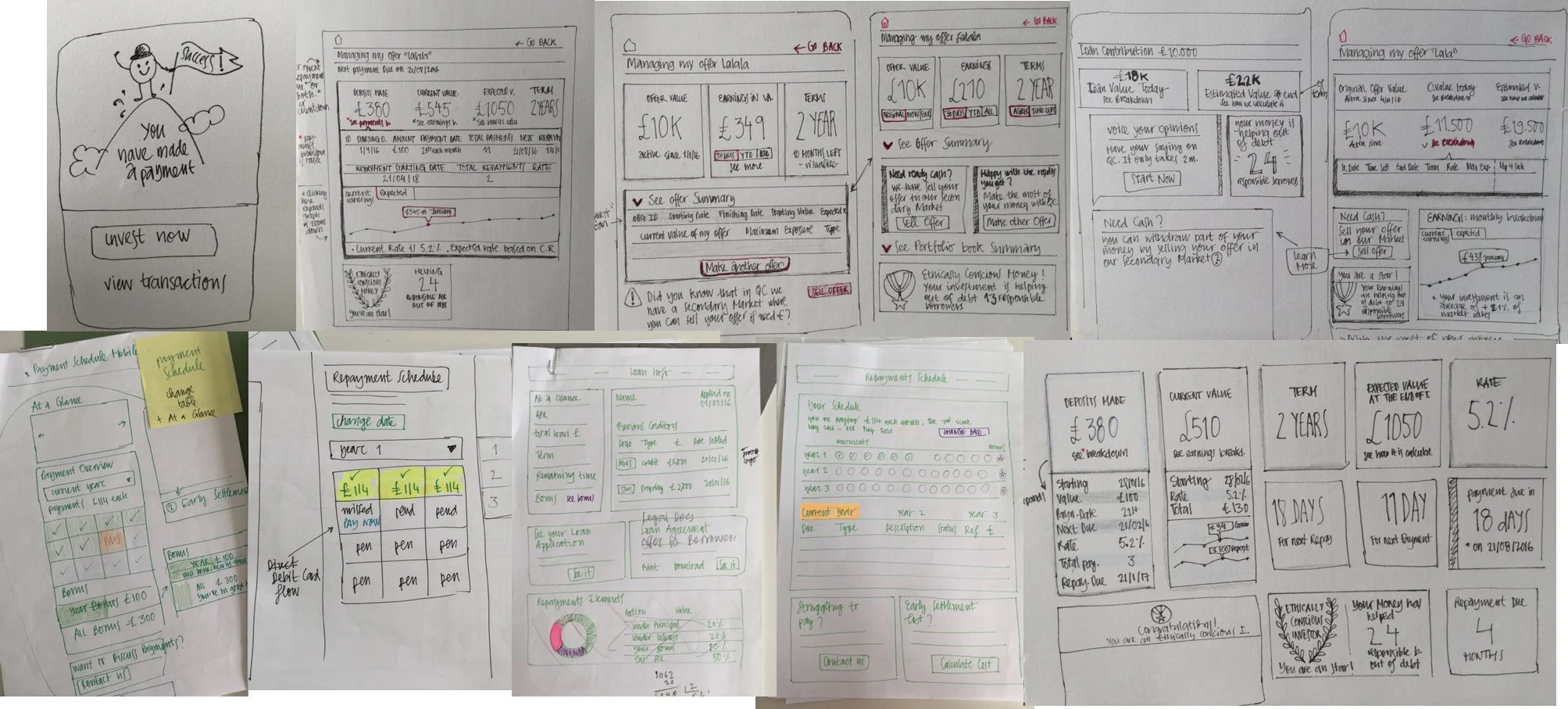

Delivered V1 as fast as possible. And learn.

Leverage the existing resources and focus in the users dashboard. And learn

Ensured transparency, simplicity and control.

Rewarding experience instead of punishing one.

Our marketplace beta was released in May 2017

We onboarded 10 users the following month, and got featured rather positively in a popular money savvy British blog…

Unfortunately, our technology wasn’t capable of scaling..

We needed more time and resources to develop and to refine our initial solution. After a few months of going live we stopped taking customers and used the platform as an “experiment” to learn and to develop the right solution that will change the way the people invest and borrow.

On a positive note, now I’ve had a design baseline..

Using analytics(GA and Hotjar) and a mixed of UX methodologies like card sorting, prototyping, and user testing I focused in learning:

The most loved and appreciated features by our users

The parts of the product that didn’t work as the users expected.

The unmet user needs in the experience